About Us

Backing Founders Recreating the World

We Invest in Transformative Companies

We focus on earlier investments in founder led companies in transformative industries. We have to date been active in New Space, Quantum & AI, New Defense, and Material Science. While more traditional funds are constrained by investment periods, transaction sizes, structure, and geographies, we remain less constrained and focus on earning strong returns from companies that are recreating our world.

Our Core Principles

While many investment firms operate within strict mandates around fund life, check size, and geography, we remain focused on the team, teachnology and the industry.

Risk-Adjusted Returns

We seek opportunities where asymmetric outcomes exist—where the potential upside meaningfully outweighs the risk. Capital is deployed selectively, with conviction, and always in pursuit of durable value creation.

Transformative Impact

We invest in companies building technologies that materially advance their industries or create entirely new ones. When successful, these businesses don’t just generate returns—they reshape markets and change our world.

What Sets Us Apart

We are not bound by traditional fund structures or rigid mandates. This flexibility allows us to invest earlier, move decisively, and partner authentically with founders at critical stages of company formation and growth. Our focus on transformative industries, combined with a long-term mindset, enables us to support companies that conventional capital often overlooks—yet are positioned to define the future.

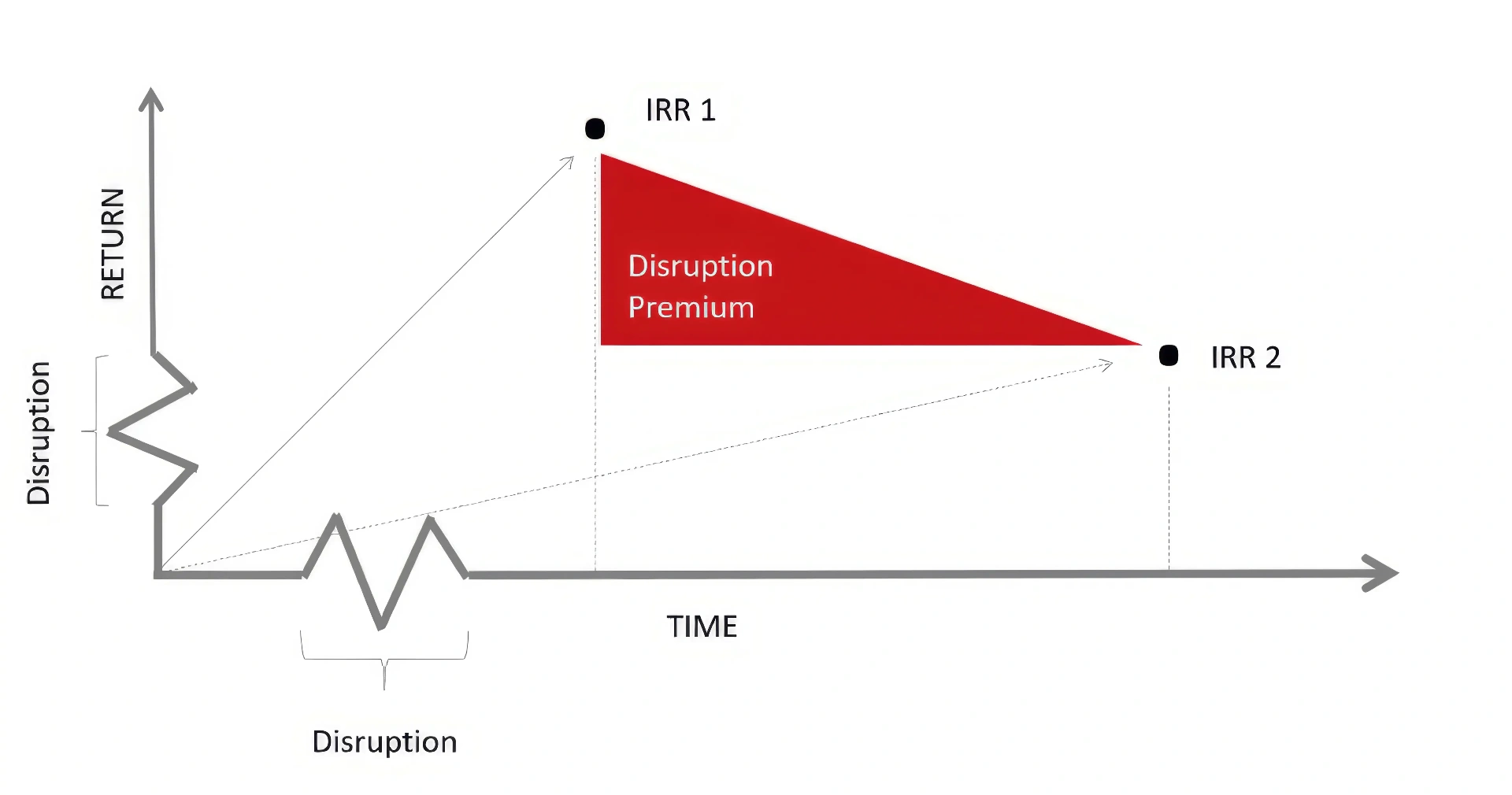

The Disruption Premium

We actively seek out the chaos of disruption because within that disruption lies extraordinary opportunity

The Disruption Premium

We refer to the area created by the migration of the exit in the return/time space as the "Disruption Premium." This premium represents the enhanced value created when both return increases and time to exit decreases.

Where We Seek These Premiums

Dynamic Industries

Sectors undergoing rapid transformation.

Kinetic Scenarios

Investment opportunities where special situations and unique scenarios create wider windows for outsized returns.